net investment income tax 2021 trusts

2 days agoHeres why you can trust us. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year.

3 8 Net Investment Income Tax Td T

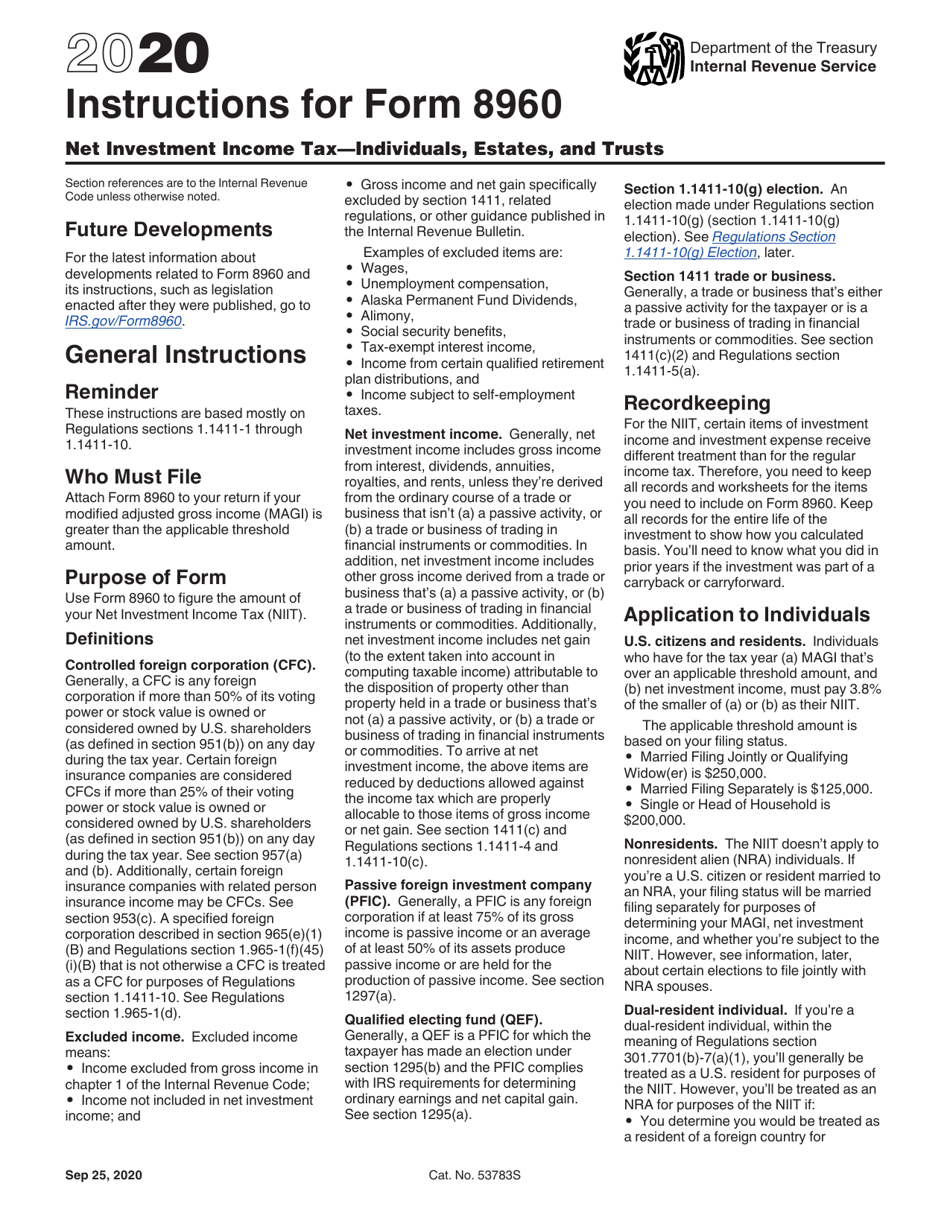

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

. Generally net investment income includes gross income from interest dividends annuities and royalties. 1 It applies to individuals families estates and trusts. Theres also an additional 38 surtax on net investment income.

The estates or trusts portion of net investment income tax is calculated on Form. Effective January 1 2013 Code Sec. 2022-08-08 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of.

Individuals with MAGI of 250000 married filing jointly or 200000 for single filers are taxed at a flat rate of 38 percent on investment income such as dividends taxable. April 28 2021 The 38 Net Investment Income Tax. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

The FICA tax rate for both employees and employers is 62 of the employees gross pay but only on wages up to 147000 for 2022 and 160200 for 2023. In addition to traditional portfolio income the NII tax applies to income and. 1411 imposes the 38-percent Net Investment Income Tax NIIT on the net investment income of individuals trusts and estates.

Wisconsin 2022 Form 5S Instructions. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Tax Bulletin 214 July 2021 page 8.

1411 tax is imposed for each tax year at a rate of 38 on the lesser of 1 the undistributed net investment income for the tax year or 2 the excess. Self-employed persons pay a similar. You are charged 38 of the lesser of net investment.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. A related entity also includes certain real estate investment trusts REITs if they are not qualified REITs For. The IRS gives you a pass.

There are seven federal income tax rates in 2023. File Your 2021 Return Today to Avoid. In the case of an estate or trust the Sec.

As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. Higher income individuals are subject to a 38-percent tax on their net investment income NII.

The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and.

Grant Distribution Summary Nina Mason Pulliam Charitable Trust

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Owning Gold And Precious Metals Doesn T Have To Be Taxing 2021

Tax Reduction Strategies For High Income Earners 2022

Download Instructions For Irs Form 8960 Net Investment Income Tax Individuals Estates And Trusts Pdf 2020 Templateroller

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

2021 Trust Tax Rates And Exemptions

How To Calculate The Net Investment Income Properly

News Articles Preservation Trust Company

Tax Advantages For Donor Advised Funds Nptrust

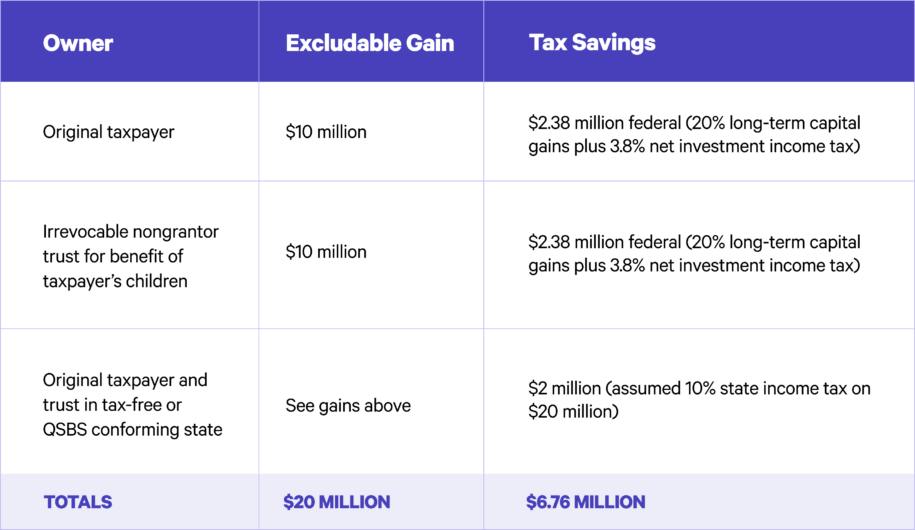

The Tax Benefits Of Qsbs Wealthfront

Capital Gains Tax In The United States Wikipedia

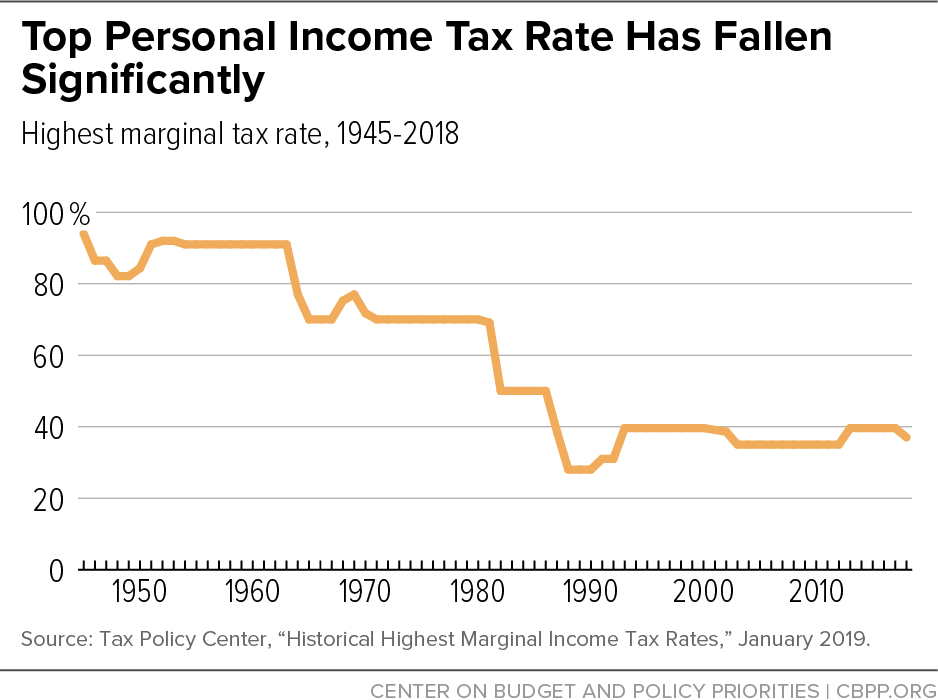

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Investment Expenses What S Tax Deductible Charles Schwab

General Revenues Should Be Part Of The Medicare Financing Solution Commonwealth Fund

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Trusts Estates And The Net Investment Income Tax Withum

Net Investment Income Tax Niit Quick Guides Asena Advisors

2021 Tax Rates And Exemption Amounts For Estates And Trusts Preservation Family Wealth Protection Planning